Why the Labor Market Is Not as Strong as You Think

By Unemployment-Extension.org | June 17, 2015 at 11:05 PM |

While the latest job market reports would seem to indicate the labor market is doing well, that may not exactly be the case. On the surface, it appears that initial jobless claims are on the decline.

According to the latest reports from the Labor Department, initial jobless claims are now hovering near a 15-year low. The Labor Department recently published data showing that initial claims for state unemployment benefits rose only slight to reach 279,000 for the week ending June 6. The previous week, claims were down to 276,000, the lowest such number since 2000.

Although initial jobless claims do continue to decrease, which could prove to be beneficial for the stock market, it must always be kept in mind that numbers released by the Department of Labor are not indicative of everything that is taking place in the labor market.

When viewing data regarding the unemployment rate, it is important to remember that the unemployment benefits claims do not measure the health of the labor market.

What Is Not Included in the Labor Data

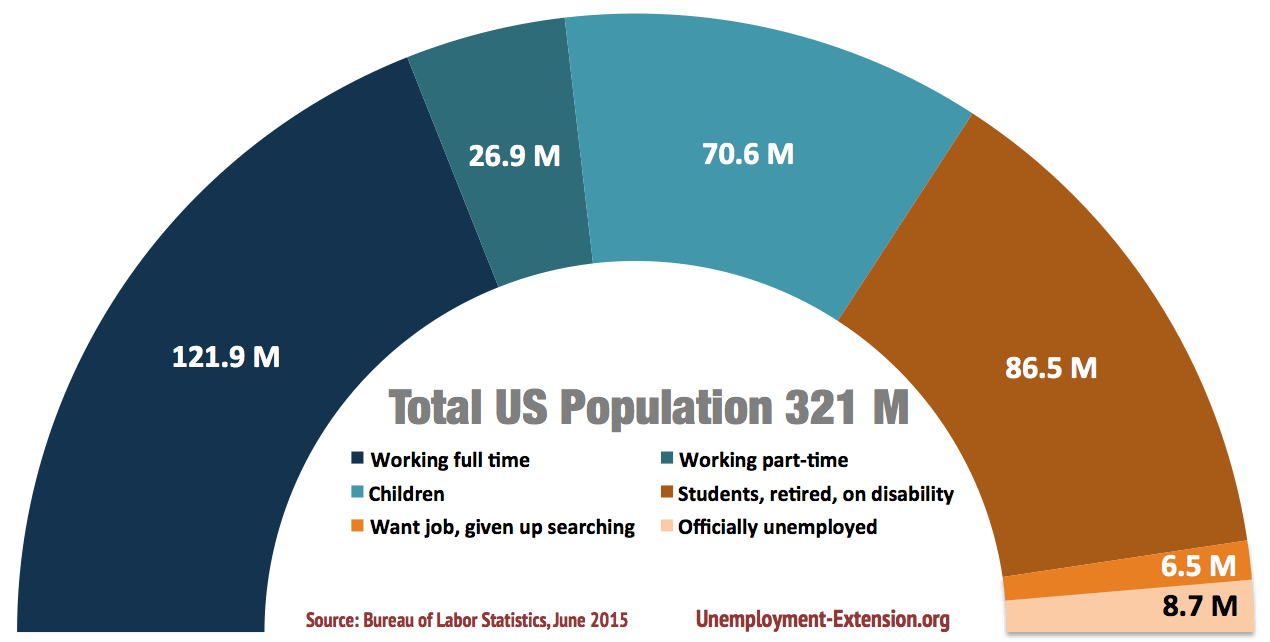

The fact that the Labor Department only includes initial jobless claims in the weekly data reports can make it difficult to see a true insight into the real health of the labor market. Other methods can provide valuable insight into what is taking place in the labor market. For instance, one reliable method could be to view the percentage of the total population in the labor force along with the portion of the labor force that is working.

It would seem as though the unemployment rate is now back to normal at a healthy 5.5%. While this should indicate a healthy and strong labor force, it may not necessarily be the case. A recent report from Forbes evidence that more than 90 million people in the United States of sixteen years and older are not working.

Of that number, the unemployed fall into a variety of categories, including those who are retired, students, and stay-at-home parents. The numbers also include individuals who would prefer to work but who have simply given up on obtaining work after having been unemployed for such a long period of time.

The reality is that government statistics provides poor insight regarding the number of people not in the labor force and the reasons why those individuals may no longer be in the labor force. In 2011, the portion of the unemployed who had been out of work for at least 52 weeks reached a high of 31.9%.

Between 2008 and 2013, there were 24 million long-term unemployed workers. According to a report released by Princeton University, after 15 months of looking for work, the long-term unemployed were more than twice as likely to completely withdraw from the labor force than those individuals who were short-term unemployed.

Since so many people left the labor force altogether, measures for long-term unemployment have tended to trend downward over the past few years.

The Great Recession ended in June of 2009. However, the number of long-term unemployed remains high with many of them being no longer included in the unemployment numbers. They also no longer qualify for jobless benefits because the program that provided extended unemployment benefits to the long-term unemployed ended in December of 2013.

While it would appear that all is rosy with the labor market, it should always be kept in mind that such numbers can be quite deceptive and are not a real measure of what is taking place.

Other Unemployment News

Unemployment and the Gender Gap: 5 Things You Should Know

What You Need to Know about the Hidden Recession

More News